ON-DEMAND WEBINAR

The state of bookkeeping as a profession has changed, but have your services evolved or expanded to meet the needs of emerging markets like Cannabis? If you are considering this industry as a great accounting niche, join us on our next webinar to discuss the following Cannabis bookkeeping issues:

A quick rundown of the state of Cannabis in 2020: Medical Cannabis is legal in 33 states and recreational Cannabis is legal in 11 states. This industry is a $20 billion dollar-market. This does not include the $70 Billion ‘illegal’ market that is waiting to enter the legal market with federal legislation being discussed in the House. Cannabis companies are highly regulated, highly complex organizations, therefore they need more than just a CPA or higher-level accountant; they need a bookkeeper to manage all of the day-to-day financial transactions that come with operating a cash-based business.

In other words, there is a huge market out there right now, with an even bigger one waiting in the wings. Are your bookkeeping services ready to capitalize on this influx of clients, needing daily bookkeeping services?

It is essential that Cannabis businesses have a team of financial experts including bookkeepers, tax preparers, and high-level accountants all working together to ensure all of their financial transactions are captured, recorded and reported properly. Otherwise, cannabis companies can be subject to fines and penalties, which include inaccurate record keeping. So, this webinar is not just for bookkeepers because it is important for everyone on the financial team for a cannabis company to understand each other's roles and responsibilities.

|

|

||

|

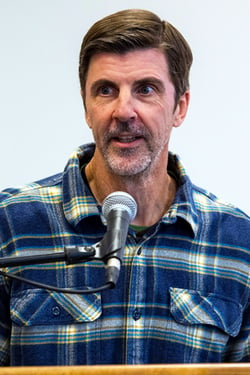

Andrew Hunzicker, CPA

Co-Founder and Owner

DOPE CFO

|

Naomi Granger, MBA, CPA

Co-Founder and Owner

DOPE CFO

|