Companies operating in both federally illegal Cannabis and federally legal CBD/hemp are subject to the complicated tax code that is 471. Broken up into many sections, only experienced and niche-trained accounting professionals can properly decipher it.

Whether intentional or not, it can be easy for Cannabis and CBD/hemp companies to get into trouble with the IRS if 471 isn’t followed exactly. We’ll help you understand 471-11, the section of the tax code that thoroughly details which costs are allowed for cultivators, processors, and manufacturers, and we’ll break down how to utilize it.

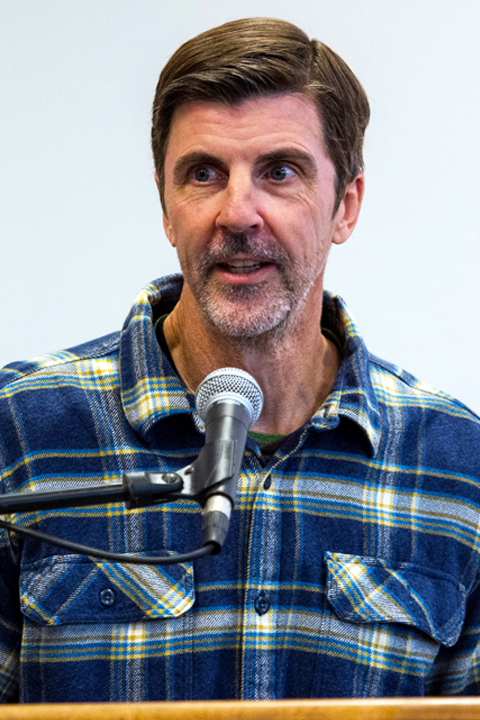

DOPE CFO founder Andrew Hunzicker, CPA leads the way as he covers the following key aspects of 471:

Cannabis companies are not allowed any deductions or credits and courts are penalizing them for messy records. According to 280E, any business associated with the “trafficking” of Schedule 1 substances may not deduct ordinary business expenses (like rent, vehicle expenses, mortgage interest, and much more). This means that the only way Cannabis companies can lower taxable income is by correctly allocating costs to inventory and Cost of Goods Sold (COGS) in compliance with 471.

Hemp is no longer subject to 280E since the passage of the 2018 Farm Bill, which declassified hemp as a Schedule 1 controlled substance, but 471 is still applicable.

The best way you can begin to navigate the intricacies of IRC 471 and keep clients compliant is through proper inventory accounting training. Join us for a 60-minute crash course on 471 inventory and COGS during our in-house webinar, “Deep Dive into IRC 471 for Cannabis and CBD/Hemp (Your Ultimate Guide to Compliant Inventory Accounting).”

DOPE CFO - Founder